There are two ways for your company to make more money. First, you could increase your sales and revenue. Second, you could reduce your expenses.

Increasing sales requires a lot of planning, strategy and moving pieces to fall in line, but reducing your company’s expenses is something you can do very easily – all it takes is a little bit of time. Here are eight ways to reduce your expenses, resulting in a larger bottom line.

1. Relocate your office to a more affordable area.

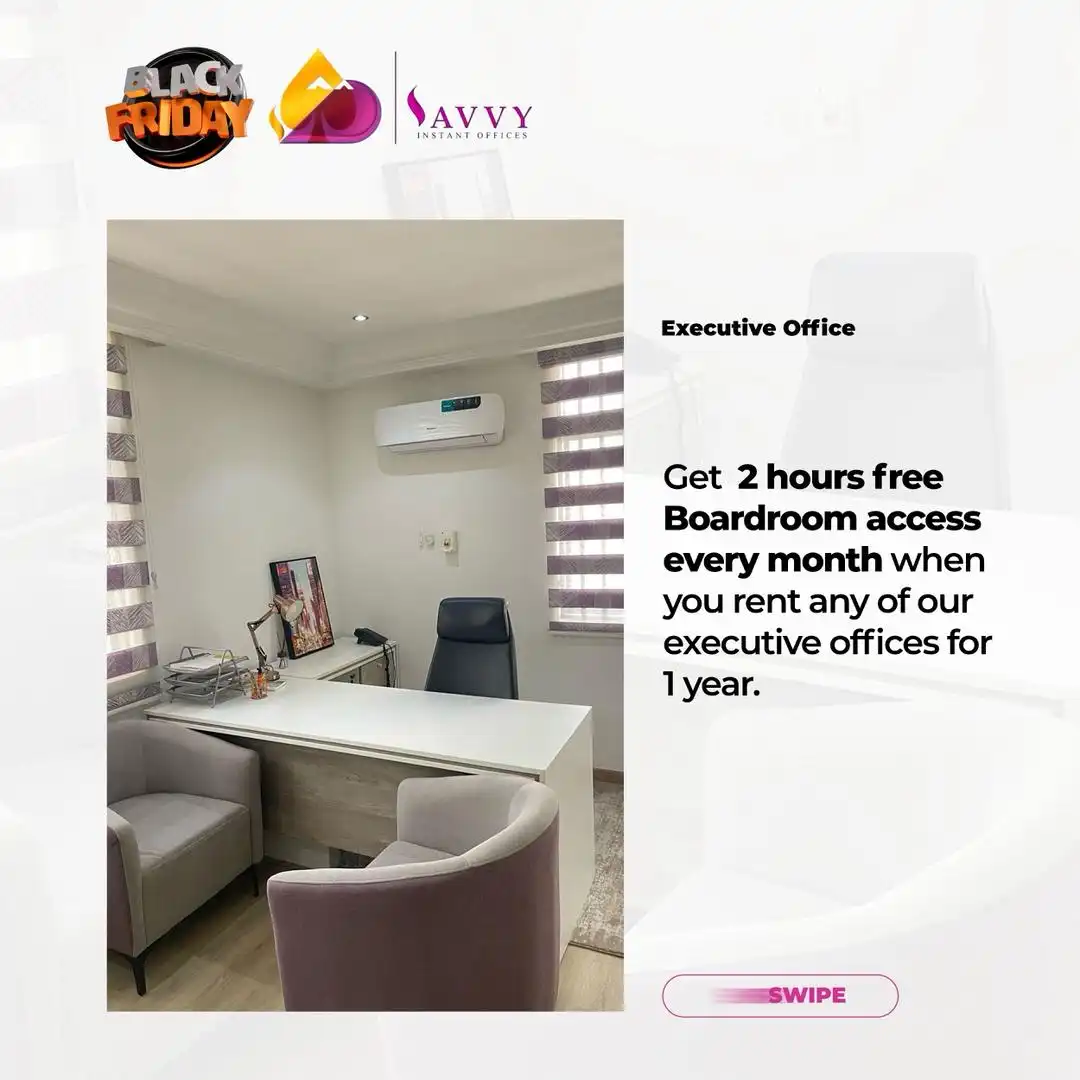

Thanks to the power of the Internet, not every business needs to rely on locations with highway access or high-foot traffic in order to be successful. Consider signing up to a virtual office package to reduce your monthly rent. Savvy Instant Offices is a great website to get everything flexible office solutions, from; serviced offices, virtual offices to affordable workstations.

Often times, especially in larger cities, the further away from the action you are, the lower the cost for commercial rent. While this won’t apply to every business, it’s something to consider if you don’t have walk-in customers, and service a customer base who isn’t local.

2. Convert your phones to a cloud-based system.

This is a tip geared more toward freelancers and solopreneurs, rather than larger businesses, but it’s something that smaller teams can consider as well. You can eliminate the cost of desk phones and high monthly plans by switching to a cloud-based system that routes calls through your mobile phone.

Most consumers would rather communicate through email, social media, live chat and web-forms, rather than pick up a phone. Take a look at your current phone usage, and if it’s minimal consider moving over to a cloud-based option.

3. Audit your monthly subscription billing.

Most businesses are subscribed to many SAAS software applications, yet never use them. You might sign up for a free trial and then forget about it, while it continues to hit your credit card month-after-month. If it’s a small ticket item, the amount might slip by undetected for a long period of time before you realize you have been wasting money.

It’s a good idea to audit your business bank statements often, at least quarterly, to see if you can spot any unnecessary spending. Cancelling unused subscription products or services can end up saving several thousands of dollars annually.

4. Turn unused office space into a co-working space.

Do you have some unused office space that’s just collecting dust? Consider subleasing it or turning it into a co-working space. Not only can this help to absorb some of your lease expense, but having more companies in the same space can help spark creativity and can lead to new partnerships and business opportunities.

You will have to check your current lease to see if subleasing is allowed, and you would most likely have to run a co-working proposal by the current landlord to see if it’s even a possibility.

5. Take advantage of travel reward credit cards.

You might be thinking, “Credit cards? Are you crazy? I want to save money, not accumulate more debt.” But there is a big difference between intelligent credit card usage and irresponsible and dangerous use.

Funneling all of your business expenses through one or two cards, and then paying off the balance in full every month is an easy way to accumulate enough points to save you a tremendous amount of money on airfare and hotels for your business travel needs.

Even if you don’t travel, there are plenty of cash back opportunities that can lead to less overall spending.

6. Always seek out multiple bids.

Whenever you are working with a vendor, manufacturer or supplier, it’s a good idea to seek out additional bids. Yes, it takes more time, but in the end the savings can have a huge impact on your bottom line.

I’ll give you a real-life example. A startup I’m involved with in the health and beauty space found a manufacturer and was set to move forward with a large production order. They only contacted two companies and then picked the supplier that they though was the best fit.

It took a day of hammering the phones and sending hundreds of emails, but in the end I was able to lock in a manufacturer that was 45 cents less expensive per unit. Now, at 10,000 units per order, that’s a savings of $4,500. Don’t be lazy. The extra work you put in can drastically reduce your expenses.

7. Constantly review, measure and optimize your ad spend.

If you have a set it and forget it mentality when it comes to paid media, such as social media, pay-per-click (PPC) and media buying, you will end up with a lot of wasted ad spend. Through my company, I consult with a lot of brands, and nine out of 10 times I find wasted ad spend simply because nobody was spending enough time on the review, measurement and optimization of the campaigns.

Split-test multiple copy and image variations of your ads, clip the non-performers, and constantly work to improve the performance of the ads that are generating a positive ROI. Reducing your cost-per-click (CPC) while increasing your conversions helps grow sales and lower your ad spend.

8. Negotiate a lower fee with your credit card processor.

If you have been with your current credit card processing company for a long time or if you are pushing a high dollar amount through them monthly, asking for a lower rate won’t hurt. If anything, it can help you reduce your processing fees, and your company retaining more of your revenue.

Most processing companies charge 2.9 percent and 30 cents per transaction, but if you have high dollar volume or longevity with them, it gives you leverage to negotiate a lower rate.